Official opening of Schmitz Cargobull factory in Manchester: a T&BB feature

By Bradley Osborne - 9th May 2023

Ribbon-cutting ceremony at Schmitz Manchester factory

UK – On 30 March, Schmitz Cargobull UK Ltd marked the official opening of its trailer assembly facility with a ribbon-cutting ceremony attended by customers and members of the press. For the city of Manchester, it means new jobs and boosted growth to its industrial sector. For the German trailer builder, it marks a triumphant return to a market from which it had to divest its manufacturing business following the 2008 financial crisis.

The event at the factory was led by Paul Avery, Managing Director of Schmitz in the UK, and Colin Maher, a new recruit in charge of Aftersales & Services for the UK and Irish markets. They were joined by Boris Billich, Chief Sales Officer, and Andreas Busacker, Chief Financial Officer, who journeyed over from the German headquarters in Horstmar. Also in attendance was the Member of Parliament for Wythenshawe and Sale East, Mike Kane, who proudly claimed that Manchester is one of the fastest-growing urban economies in Europe.

Production at the new facility in Wythenshawe – just outside of Manchester – started with a soft launch at the end of 2021. The occasion was marked back then by a virtual event broadcast to customers and the press, who were prevented from attending due to pandemic-related restrictions. And so, the in-person event held in March also represented an end to limited-scale production and the start of ramp up and full operations at the factory.

Over a decade ago, Schmitz took the decision to mothball its former trailer manufacturing facility in Harelaw, in the North East of England. The measure was taken in order to quickly cut the group’s costs, which had become unsustainable as sales fell across Europe as a result of the post-2008 economic downturn. However, Billich told the press at the opening of the new factory that Schmitz always intended to revive its trailer manufacturing in the UK once the market conditions allowed for it. With its looser restrictions on trailer dimensions and specifications, the UK and Irish market presents a unique opportunity to any European trailer manufacturer, and so it was only a matter of time before Schmitz made its second attempt on UK soil – a long-term goal which was reportedly unaffected by the UK’s withdrawal from the European Union.

Trailers produced at the Schmitz factory in Manchester

The S.KO Pace is the first trailer model to enter production at the Manchester site. The 13.6-metre trailer comes in a range of interior heights (2.6m, 2.8m, and 3.2m) and can be ordered in tri-axle or tandem axle configurations. The Pace is installed with Schmitz Cargobull’s own ‘ROTOS’ axles, ‘TrailerConnect’ telematics, and disc brakes as standard (with the option to replace these with drum brakes).

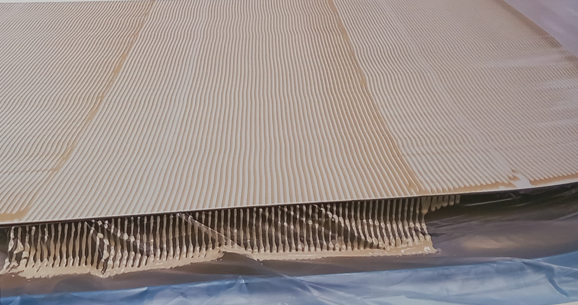

'Honeycombed' interior of Struktoplast panel

The S.KO Pace’s most distinctive feature is its ‘Struktoplast’ panelling, made from lightweight polypropylene. The outer skin surrounds a “honeycombed” interior, which provides strength and durability while keeping it up to 700 kg lighter than conventional panelling made of plywood. The Struktoplast panels are made and installed on the trailer on site. The lightweight Pace – intended for dry freight and fresh goods (i.e., non-refrigerated) transportation – is proving so popular that Schmitz is exporting it to customers on the Continent. Eventually, Schmitz plans to start producing Struktoplast panels at its facility in Zaragoza, Spain as well.

More recent is the ‘S.CS Freepost’, one of Schmitz’s curtainsiders assembled alongside the ‘S.CS Fixed Roof’ at the Manchester factory. Free of sliding posts, the semi-trailer offers unobstructed space to load and unload up to a side aperture height of 3.2m. The curtain can be tensioned from the front and the rear. Inside the trailer, additional lashing rings can be provided for greater load securing. The curtain is fitted with a 1.8m anti-slash mesh.

The S.CS Freepost is fitted with a fixed aluminium roof, galvanised steel cant rails, and a reinforced chassis structure. These meet TÜV test requirements and are certified to EN 12642-XL standards. The curtainsider, which was designed specifically for the UK and Irish markets, was developed in parallel with the Pace but was finished later, reaching the prototype stage in March of last year. It can be specified to a height between 4.2m and 4.8m, higher than the 4m limit which is imposed on the Continent.

Along with the Pace and the curtainsiders, Schmitz UK also sells the rest of the group’s product portfolio, which it imports from Europe.

The S.CS Freepost

Schmitz UK and Europe financials

Schmitz CFO Busacker presented group figures forecasted for the 2022/23 financial year. The company is expected to have produced 65,000 units, with sales generating EUR2.8bn. These numbers represent solid improvements over the figures released for the previous financial year, which showed that Schmitz produced 61,000 units and made EUR2.3bn in 2021/22. The company hopes to have achieved earnings (before interest and taxes) of EUR80.8m for 2022/23, a great improvement compared to the losses of the year before.

The past year has been one of expansion all around for Schmitz. Busacker said the company increased its budget for capital expenditure by 26%, bringing its total investment in new plant and in digitisation to over EUR60m. On the digital side, Schmitz is looking to rapidly expand the number of TrailerConnect telematics units in its customers’ fleets (as well as in trailers made by its competitors). More than 69,000 telematics units were in service at the end of 2022. By the end of February 2023, this figure jumped to 96,300 units. All new Schmitz trailers are installed with telematics hardware as standard, and the company aims to have 250,000 connected trailers on the road in 2025.

Based on figures obtained for January to November 2022, Busacker claimed that Schmitz captured around a quarter of the semi-trailer market in Europe. It led several of the major segments, with shares of 49% in the market for refrigerated trailers, 27% in curtainsiders, 22% in dry freight trailers, and 16% in tippers.

The UK is a market where Schmitz has historically struggled to attain the same level of dominance as it has in markets on the Continent. Busacker said that Schmitz currently holds a 6% share of the UK trailer market. Being in the top 5 European markets, the UK is a tantalising prize, representing a significant opportunity for Schmitz. Busacker laid out the total addressable market as follows: approximately 24,000 trailers sold per annum; of which 8,000 are curtainsiders, 3,000 to 4,000 are reefers, 3,000 dry freight trailers, and 1,500 tippers.

In the financial year 2023/24, Schmitz aims to achieve the following:

A turnover of GBP97m;

1,070 units produced at the Manchester factory;

1,700 units sold;

Growth in market share from 6% to 14%.

Details of the factory

Avery told T&BB that when Schmitz was planning its return to the UK, the North West of England, with its central location on the island of Great Britain and its industrial heritage, was the place where the company wanted most to set up its new manufacturing operations. When the property which the trailer builder now occupies first came onto the market, however, the Schmitz UK team had misgivings. For one thing, the building was an empty hull, stripped bare of electrics and other basic amenities which the company would have to pay out for to get the place ready for plant installation. The other problem was that the premises did not come with a trailer park. There was space for one right next to the building, but frustratingly for Schmitz it was let by a neighbouring property. The team at Schmitz UK decided to hold off from leasing the property, and they weren’t to wait very long to be rewarded for their forbearance: the premises returned to the market, this time with the adjacent space for a trailer park included in the lease.

The factory was first built in 1952 for producing train transformers. It is an 8,500-square-metre building, with about 310 square metres given over to offices. Schmitz UK told the audience that it “started from scratch” to fit the place out with the essentials; this was finished by April 2021, when the team started moving staff and equipment into the facility. In May 2022, the factory achieved ISO 9001 certification. The trailer park outside the building has an area of 4,600 square metres, providing space for up to 75 trailers. Total investment in the facility to date has totalled GBP2.5m.

Production floor inside the Manchester facility

The production floor works on the Toyota principle of ‘lean’ or ‘just-in-time’ manufacturing. The primary manufacturing work done at the factory is the making of the Struktoplast panelling for the Pace. Once the panels are made, they move to the other side of the building where the trailer assembly takes place. No welding is done in the facility: every part is bolted on to the frame, which makes for quick and easy assembly; and disassembly, when parts need to be replaced later in the trailer’s life. The galvanised trailer chassis and the axles are shipped to Manchester from Schmitz’s German plant in Altenberge, North Rhine-Westphalia. Schmitz UK told us that the factory’s production capacity is 60 trailers a week on a single-shift working pattern, though the average output is more like 30 to 35. The workers are employed on a flexible hours basis, meaning that they work more at peak production times and less during lean times while retaining a stable flow of income, according to Schmitz UK. Lead times for new trailers currently stand at about 10 weeks.

An engineer told me that he and others working on the production floor that Schmitz UK took on several of the workers that were laid off when the Cartwright Group went under in 2020. When the group’s trailer operations, under ‘S Cartwright & Sons (Coachbuilders) Ltd’ and ‘Cartwright Fabrications’, in nearby Altrincham were shut down, 490 redundancies were made and the trailer side of the business was abandoned.1 The workers whom Schmitz UK rescued from the wreck of Cartwright bring with them the combined experience of a manufacturer who lasted 68 years in the business.

It is a peculiar and ironic outcome, that the waning of Cartwright’s star – a result of the economic downturn brought on by pandemic restrictions in 2020 – should benefit Schmitz, whose business in the UK had earlier suffered from the economic crisis of 2008. That, of course, is the way these things tend to go in times of economic trouble, a game of winners and losers. Company CFO Busacker was under no illusion that Schmitz has somehow become immune to crisis. He warned of the destabilising effects of global inflation, of the war in Ukraine, and of a potential conflict over Taiwan, all of which would have repercussions for Schmitz’s business. Nevertheless, the staff at Schmitz UK were excited about the revival of trailer production in Great Britain, and they are confident that, this time, Schmitz has returned for good.

1 The service and finance sides of the business were acquired by Contract Vehicles, while the vehicle conversion subsidiary was sold to Trek Group – see T&BB’s report from 2021.