World economic outlook paints a picture of rising global commercial vehicle demand in the short term – says GlobalData

By Jim Gibbins - 26th September 2023

Global truck sales by region (Image: Global Data)

UK / World - ‘Slightly over a year ago, just as the world was starting to pull out of a couple of years of crisis and there appeared to be a light at the end of the tunnel (Covid was starting to disappear and the supply chain shortages began to ease with semi-conductors becoming more available), everything was thrown into disarray again with the Russian invasion of the Ukraine in February (2022). This has had significant global economic consequences over the past year and a few months with disruption of commodity and energy supplies stoking inflation and resulting in renewed supply chain pressures and cutbacks.’ This is a paraphrase of the opening remarks of Zita Zigan, head of global truck forecasting at Global Data based in London, UK, speaking at a half year round up of the global truck markets.

T1 - Global Data - Economic Outlook

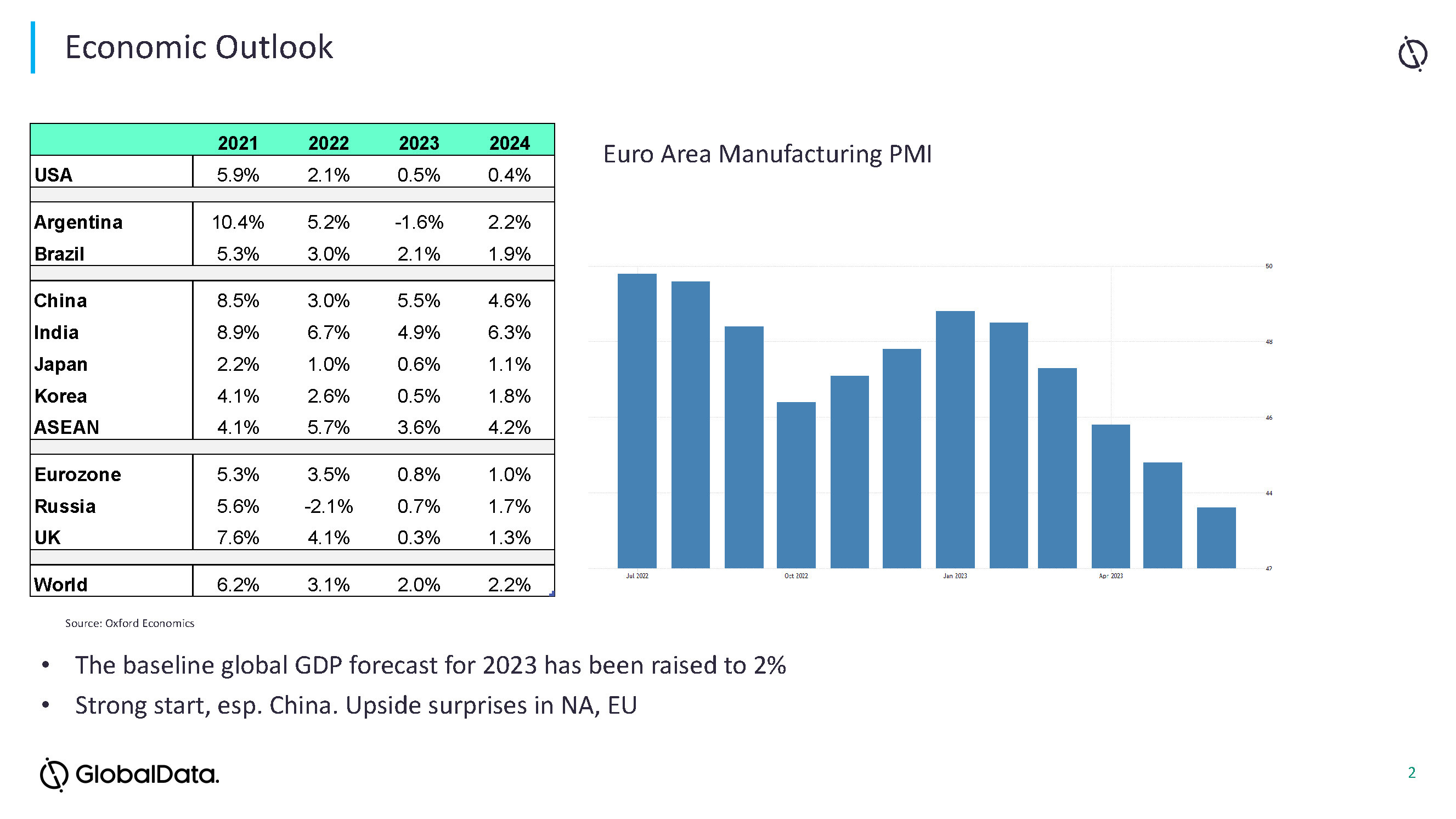

The Ukraine war and supply constraints drove up prices of energy, materials and subsequently consumer goods causing inflation in many economies to rise sharply and often by the most percentage increases in decades. Although inflationary pressures, Zigan remarked, are starting to abate.

In recent months, however, the outlook has brightened, she continued, saying that global GDP was expected to grow by 2%, and, while this is markedly lower than last year, it is better than had been expected just three months ago, particularly in China, after the zero covid restrictions were lifted. However, the current global GDP forecast for 2024 has been lowered from 2.6% to 2.2%. Also, whilst recent economic indicators suggest that economies are not heading for a major economic downtown, there is still high levels of uncertainty that neither North America nor, the Eurozone, will avoid recession altogether.

Global truck demand to rise by 6% to 7% in 2023

“The truck market has been responding positively in the main and the global truck market is poised for growth over the year ahead,” stated Zigan. “The globally Seasonally Adjusted Annualised Selling Rate (SAAR) has staged a gradual recovery after bottoming out in the second quarter of 2022 with positive year-on-year growth since then.”

-including-and-excluding-China..jpg)

T2 - Global Data - Global truck sales (SAAR) including and excluding China.

The outlook over the year ahead is mixed with signs of recovery in emerging markets and China due to easing pressures of rising prices, inflation and supply chain. While it will take a while for the pressures to filter through it will create a more positive economic background for global truck demand and production, which is expected to grow by 6% to 7%.

Benchmarked on 2019, the charts below show that Europe and North America have followed similar steady demand paths, whereas, the emerging market of Brazil, has shown much greater volatility and variance with China and India showing massive swings. India, however, has been performing robustly lately, and Brazil is now in the middle of a steep correction, Zigan pointed out.

-for-Europe-and-North-America-(left)-and-BIC-countries-(Right).jpg)

T3 - Global Data - Global truck sales (SAAR) for Europe and North America (left) and BIC countries (Right)

Heavy truck demand stands firm

The global market by weight segment (see chart) shows Heavy-duty trucks remained the key beneficiary early in the pandemic and immediately post pandemic. Initially heavy trucks outperformed every other sector very significantly, but sales over the past year have been hit by supply constraints – however, the markets are now improving as supply constraints diminish.

Medium truck demand has tracked the light truck market very closely and demand is now just short of where it was before the pandemic, Zigan stated. The bus and coach markets have been uniquely vulnerable to the shock of the pandemic, she added, and although demand has been gradually improving, even now it’s still more than 20% below the 2019 sales level.

-by-weight-segment---HD,-MD-and-Bus.jpg)

T4 - Global Data - Global truck sales (SAAR) by weight segment - HD, MD and Bus

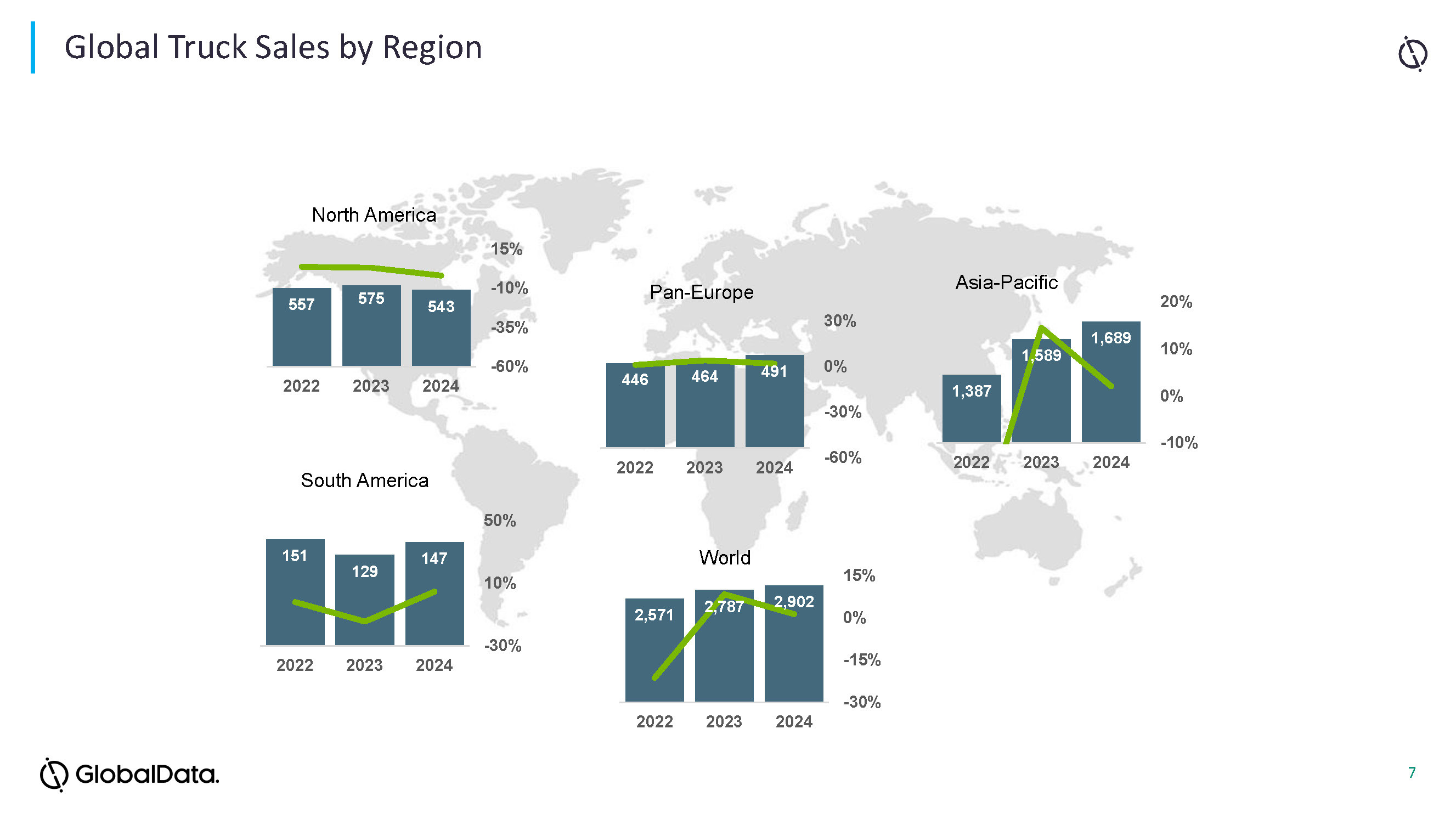

China drags world truck sales down by 21% in 2022

The bar charts below show the short term outlook of the markets by region and practically each one has outperformed the forecasts in Q1 of this year, stated Zigan. “The global medium and heavy truck market,” Zigan said, “is forecast to recover this year after a significant drop last year (2022) of 21%, this being driven, almost entirely by a post emissions deadline crash in China. The CN6 emissions deadline in China drove unprecedented pre-buy in 2021, that was followed by a large correction with a heavy impact on the global sales last year. The 2022 truck demand correction was exacerbated by new lockdown restrictions and the war in Ukraine.”

World truck sales (excluding China) in 2022 up by 6.5%

However, world truck sales, excluding China, were much better in 2022, posting a solid gain of 6.5% with sale just below the pre-pandemic level. This rise in demand was due to unmet pent up demand, which remains today as the supply chain continues to limit market size, with manufacturers having long order backlogs with semi-conductor (and material shortages) continuing to be the main factor in limiting inventory market size especially in Europe and North America, although this is less pronounced in the MD and HD sectors than the LD segment. It is expected, however, that price and supply pressures will ease this year will a global baseline truck market recovery this year of 10%. (However, this is not to say that this forecast is still susceptible to an escalation of the war in the Ukraine and high inflationary pressures continuing. This could mean that the underlying strong replacement demand that is buoying the markets in Europe and North America drains away).

T5 - Global Data - Global truck sales by region

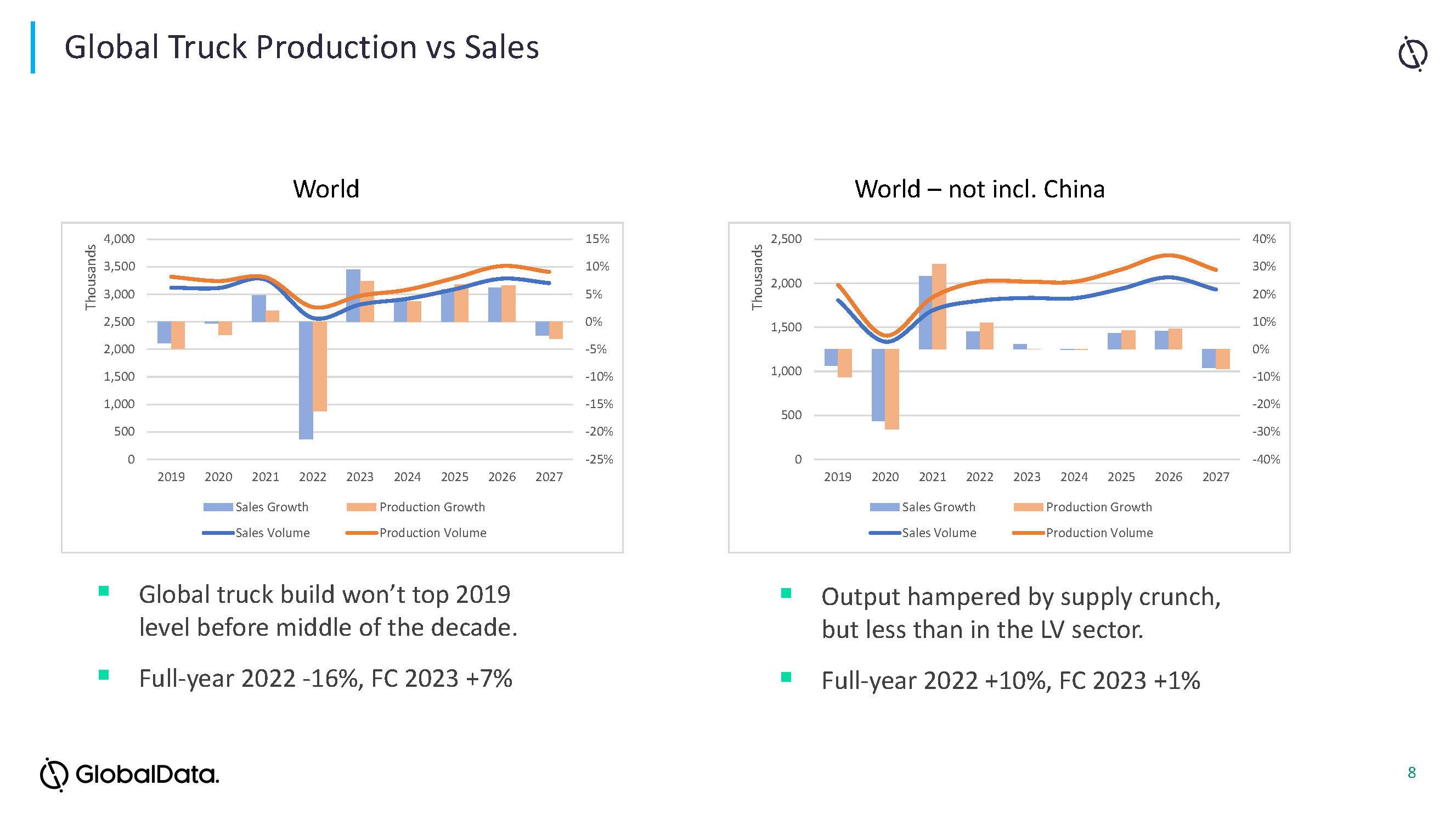

Global production to rise 7% in 2023

Production in Europe and North America has been greatly impacted by the disruptions to component supply over the last couple of years with lead times for semi-conductors rising to six months or more alongside wiring harness shortages with Ukraine being a major producer. However, long order books and high levels of pent-up demand coupled with the emerging rebound in China are ensuring that global truck production will grow at a good pace in 2023 of around 7% after falling by 16% in 2022.

Beyond 2023

Beyond 2023, emissions deadlines and other regulatory changes will be driving addition demand in many markets, Zigan stated. Cyclical downturns and slowdowns are anticipated to affect demand in 2027 and 2031, with China continuing to dominate the overall global picture. Excluding China, production grew by 10% last year and is forecast to rise 1% this year.

T6 - Global Data - Global truck sales v production

European truck market to rise 7% this year (28 countries)

High underlying demand hasn’t really translated into truck orders because of supply issues, as build slot allocations became more restricted because of record order backlogs, stated Zigan. This has meant that underlying demand remained very strong moving into this year and that this has continued because of shortages in supply.

Zigan said that the European truck market had remained robust in 2022, rising 5% on the previous year, having been limited in its growth by supply constraints. Western and Eastern European markets showed different growth rates of 3% and 13% respectively, with the European Mobility package introduced in February 2022 affected sales in accession states in the summer of 2022, Zigan explained.

Economic conditions have improved in recent months and so sales too have been adjusted upwards to reflect this. This growth in sales continued in the first quarter this year with full year sales in 2023 expected across Europe (28) to rise by 7% with the balance of growth this year expected to shift from ‘Eastern Europe’ to Western Europe. OEM’s will continue to carefully manage their build rates as conditions ease.

EU CO2 targets in 2025 and 2030, are expected to drive additional demand in 2024 and 2029. These stringent emissions targets are expected to deliver market turbulence in a familiar turbulence of pre-buy and subsequent buyback contracts have had in the past.

-.jpg)

T7 - Global Data - Truck sales in Europe (28)

Markets outside ‘EU28’

Outside the ‘EU’, Turkey has been affected by earthquake, but demand continues to be strong with sales increases of 24% in 2022 and 16% forecast this year. it is expected to see a similar growth this year in Russia, which finished at some 85,000 units, a decline of 15% against 2021.

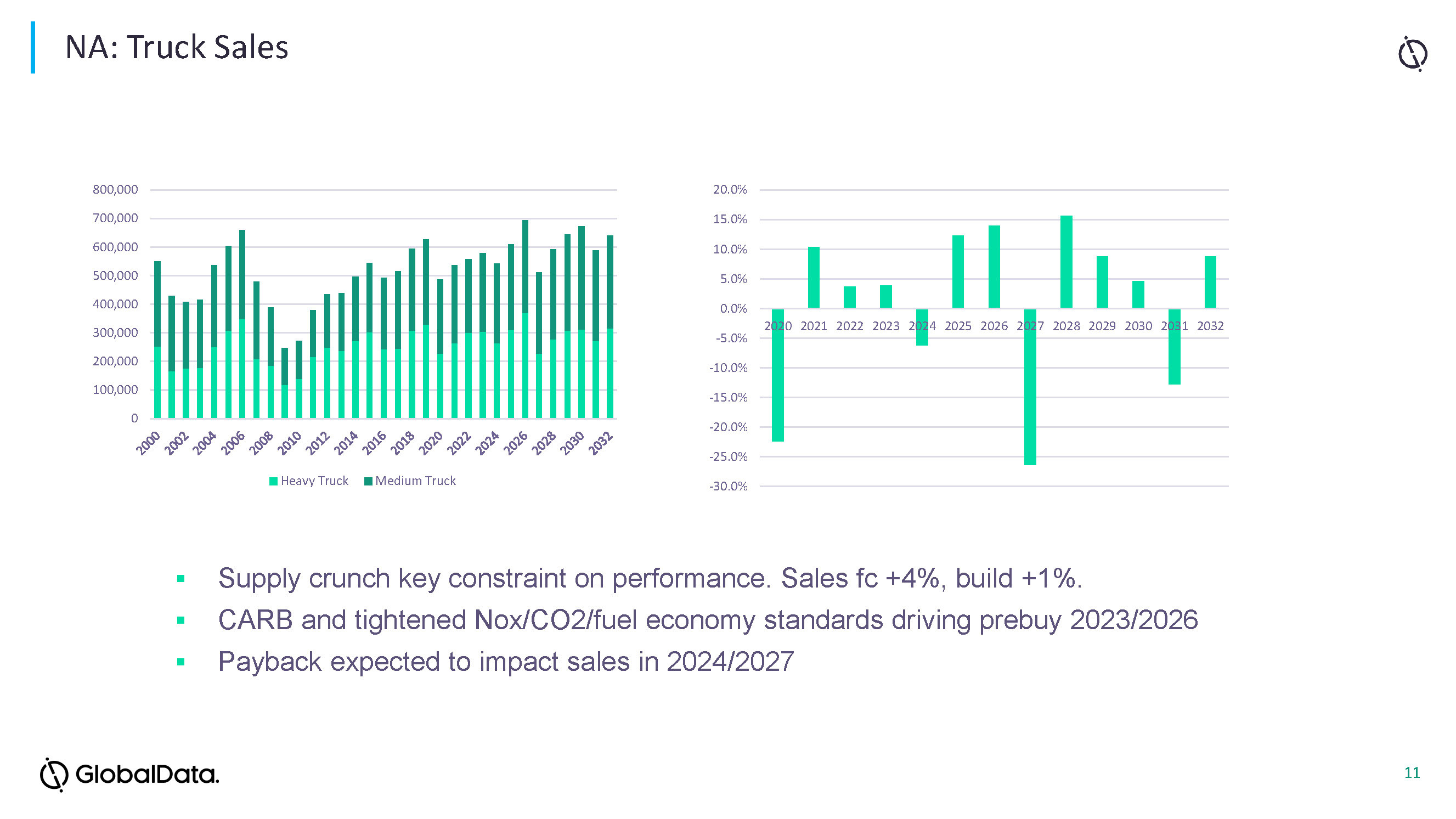

North American market

North America is expected to perform reasonably now in 2023 as persistently solid employment markets have continued to keep the truck markets moving. While inflation is a challenge it is abating, resulting in an upward forecast in Class 8 truck sales for this year, stated Zigan. Further out, truck sales volumes will spike in years 2023 and 2026, prior to introduction of further emissions reducing legislation set by the EPA for the whole country effective from 2027.*

T8 - Global Data - Truck sales in North America with forecast.

Brazil market

The Brazilian truck market underperformed expectations last year because the economic outlook soured over the course of 2022. The scale of the pre-buy in 2022 ahead of Proconve P8 emissions introduction in January 2023 didn’t quite materialise as predicted because the industry was hampered by component shortages impacting deliveries. Nevertheless, the emissions changeover combined with high demand from the agricultural sector led to high demand, particularly in the second half of the year, which led to 119,000 medium to heavy duty trucks in 2022, down some 2% compared with the year before. Brazil is currently undergoing a correction following the pre-buy in 2022. The first quarter was positive by 2%, but truck sales are expected to decline 19% in 2023 to some 97,000 units, with production decreasing by more than a third. Anticipated lack of infrastructure investment is likely to impact truck demand (as it did under the Lula da Silva government previously) and so while recovery is forecast in 2024 with steady year on year growth for the some seven to eight years thereafter, the truck market (>6t) is unlikely to reach 120,000 again before 2025.

T9 - Global Data - Truck sales in Brazil with forecast.

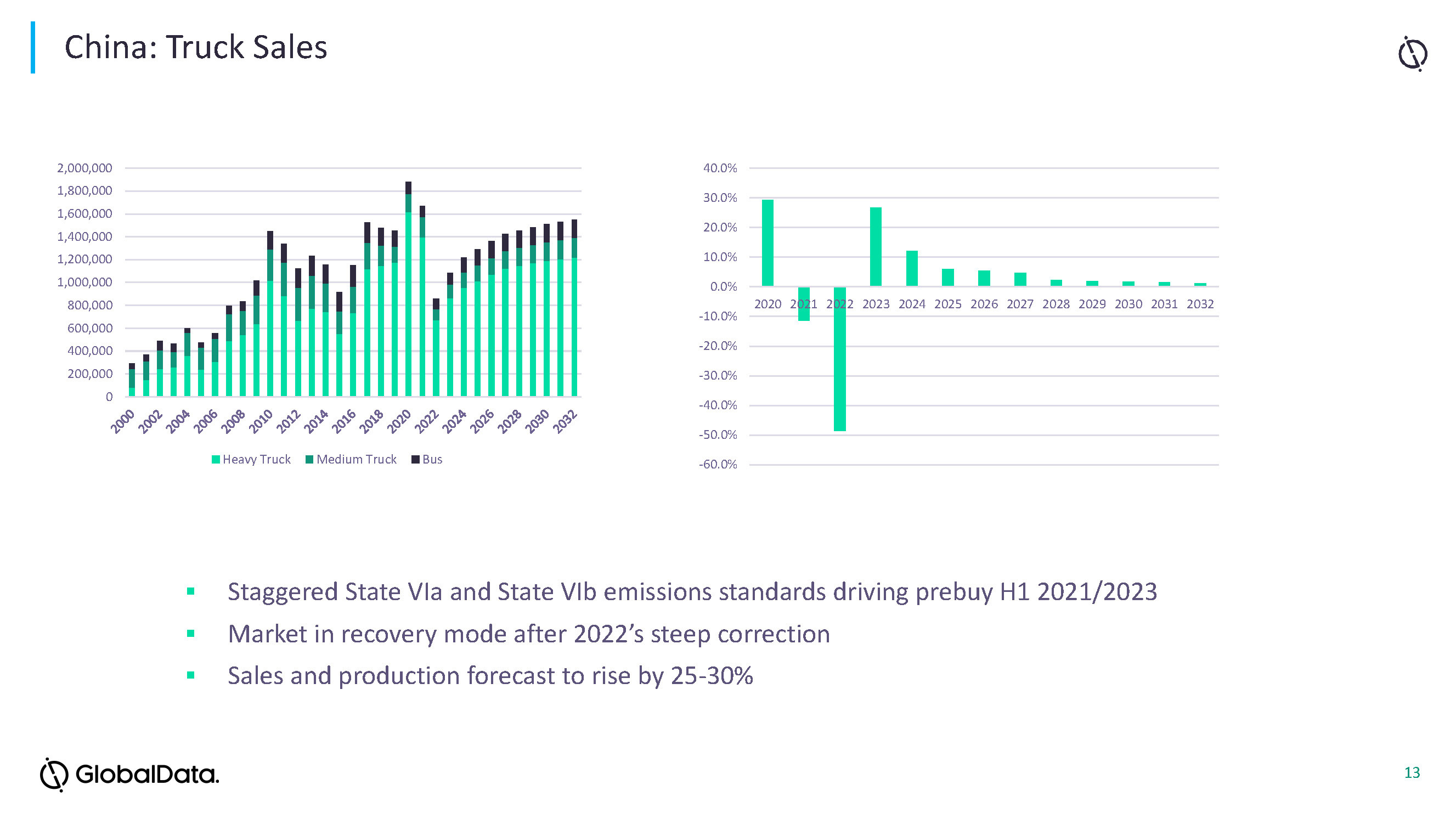

China market

China’s GDP growth has been upgraded to 5.5%, resulting from a consumer-led rebound in Q1 and into Q2, topping GDP expectations. However, truck demand is likely to be affected by the softening of growth in the agricultural, construction and manufacturing sectors, the industrial areas traditionally influencing truck demand.

Signs of recovery this year have emerged after the Covid shutdowns last year, which saw a 51% decline in the market from circa 1.6 million trucks (MD/HD) to 750,000 units. The market has also been affected by introduction of stricter emissions standards over the last couple of years, with states being responsible for implementation of CN VIa and CN VIb standards, which has been driving pre-buy sales in 2021/2022 and a steep correction this year. Although Global Data is still forecasting a 25-30% rise in sales this year to one million units, the Chinese economy is now being hit by the housing market with oversupply after many years of endless construction to shore up the economy and from the impact of longer Covid restrictions than anywhere else in the world. Production mirrored sales, falling by 49% in 2022. The slow economy and relatively new truck park (which have underused in recent years) will impact truck demand in the short term as they won’t need replacing in the normal short 5 year replacement cycle. Nevertheless, economic growth demands freight transportation and government policy is expected to accelerate growth for low and zero emission trucks.

T10 - Global Data - Truck sales in China with forecast.

Indian market

A look at India, 2022 saw a spectacular rise to some 350,000 (MD&HD) trucks based on strong economic growth. Zigan pointed out that sales growth seen in 2021 and 2022 was now easing back this year by about 2%, but recognising there was still high levels of pent up demand. Sales in the fourth fiscal quarter this year (January to March 2023) accelerated due to the high pre-buy levels ahead of the introduction of Bharat Stage VI Phase 2 at the start of Q1/FY2023-24. The government’s vehicle scrappage scheme for old vehicles (introduced for government public vehicles in April 2022 and private medium and heavy vehicles in April 2023) has been driving replacement demand, said Zigan. Furthermore, introduction of mandatory ‘fitness tests,’ i.e., that a vehicle complies with certain mechanical compliance standards to operate being introduced in June 2024, is expected to create demand for new vehicles in the second half of the year as vehicles are mandatorily scrapped.

T11 - Global Data - Truck sales in India with forecast.

Outlook

There are a lot of negative factors potentially impacting the truck market sector, namely energy and fuel prices, inflation, semi-conductor and other key component shortages, business confidence, worsening relationships between different world regions, driver shortages, environmental restrictions and the list goes on. It is because of so many uncertainties that could potentially impact future demand and output that the forecasting is based on removing the more extreme impacting factors. On a positive note, there are signs that key cost (energy and component supply) pressures are easing, subsequently, Global Data’s outlook statement is as follows: “Gradual improvement in the macroeconomic and industry outlook have resulted in successive upwards forecast revisions over the last 12 months. The short term outlook (for truck demand) is positive with growth rates unlikely to be maintained beyond 2023.”

*EPA 2027 emission standards for heavy-duty engines and vehicles (Source: Dieselnet.com). ‘The final rule is a compromise between the two proposed options {by the EPA back in 2021/22}. It is a one-step program effective from model year 2027, with a certification NOx standard of 0.035 g/bhp-hr (FTP) for all engine categories and an effective in-use NOx standard of 0.050 g/bhp-hr for medium- and heavy-duty engines (HDE). The 0.035 g/bhp-hr standard represents an 82.5% reduction in NOx emissions from the current NOx standard of 0.2 g/bhp-hr.

The regulation introduces new NOx, PM, HC, and CO emission standards for heavy-duty engines, including standards for the existing SET and FTP laboratory test cycles, as well as new standards based on the Low Load Cycle (LLC).’