BAE Systems’ Power & Propulsion Solutions is diversifying its customer base

By Jim Gibbins - 2nd November 2023

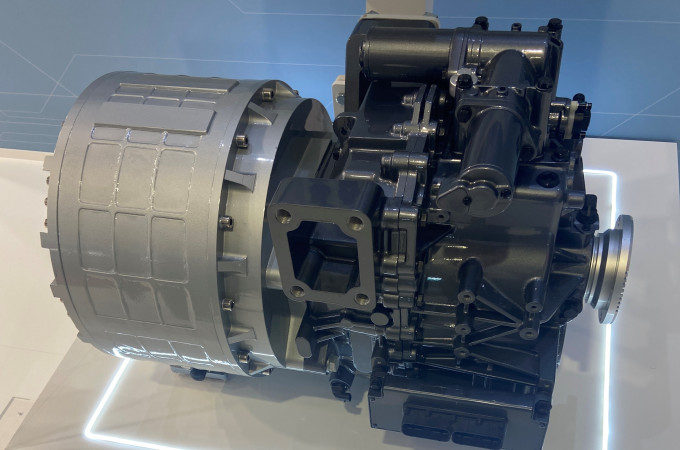

BAE Systems Gen 3 electric motor coupled to an Eaton 4-speed transmission on display at Busworld.

USA - While the Power & Propulsion Solutions (PPS) business unit of BAE Systems Inc of Endicott, NY continues to focus and support its core customer base of supplying series hybrid and full electric powertrains to the Transit bus markets in Europe and North America - it has sold more than 16,000 systems since its sector entry more than 25 years ago - it is now exploring the potential of new applications for its electric powertrain systems, with a focus on truck, terminal tractors, marine, industrial and military applications.

According to BAE Systems’ Tom Webb, Director Business Development, this potential for diversification has been on the cards for some time but the Covid pandemic very much delayed and slowed the market discovery process, which in turn delayed the company’s progress in analysing the different potential market segments. However, as the world opened up for travel in 2022, he and his team were more able to visit some of the major shows and potential customers across the Americas and in Europe to assess the marketplace.

BAE Systems’ Tom Webb, Director Business Development.

Truck market ready to embrace electrification

Webb said the market landscape and conditions today for hybrid and electric are very different to that of 1990s, when hybridisation and electrification was seen as a novelty and not mainstream. BAE Systems back then was very much a pioneer in this area, and certainly one that shaped the electric hybrid market in transit, particularly in North America and Europe. However, that experience and product development of BAE Systems in Series electric hybrid systems in transit bus has put BAE Systems PPS division into a strong position to win new business in other market segments today.

While Webb acknowledges that the truck segment is huge compared with bus (unless it is narrowed down into very specific segments) he sees the main difference to transit bus 25 to 30 years ago is that electrification in truck today is now being embraced and accepted in many markets worldwide. However, acceptance of the electric drive and its adoption, currently perhaps, comes more so from existing OEMs and manufacturing startups, rather than the actual operators in the marketplace. By way of insight into the company’s discovery and the current market trends in truck, he proffered some thoughts from his visit to Europe’s biggest show, the IAA in Hanover, Germany in September 2022. He said that on the Daimler Truck stand there were some 20 vehicles and there was not one with an internal diesel combustion engine. “But press them on sales, it was less than half a per cent of revenues, but it zero emission was probably 100% of their marketing, and a very significant proportion of their product investment. So, one concludes that while vehicle manufacturers are all offering electrified products, they are not yet really being sold in any real numbers. The next question is how mature are those products, and what is the real end game product – is it battery electric, hydrogen fuel cell electric, or hydrogen internal combustion engine electric or the hydrogen internal combustion engine?”

“So, right now the two key issues with the electric truck today are that operators can’t ‘fuel’ it and they can’t see a business case for it … yet!”

The development of the clean and zero emission truck markets {outside China} will still take some time, concludes Webb. This is not because of the lack of options available to fossil-fuelled vehicles, but due of the lack of infrastructure to fuel or power these vehicles and of the current comparatively high TCO when measured against diesel powered trucks.

Webb said:

When I asked OEMs in North America recently, ‘how are sales,’ they say, ‘well we think will do 300 zero emission units next year (2023) and maybe 1,200 year after that,’ I ask, ‘are any of those being sold without a subsidy?’, and the answer is, ‘very few!’ My next question is, ‘Is there a business case without subsidy,’ and very quickly the answer from the head engineer at one of the world’s biggest OEMs for the product is, ‘No, there is no business case!’ My next question is, ‘Do you still think zero emissions is the future?’, and the answer is, ‘Absolutely. So, right now the two key issues with the electric truck today are that operators can’t ‘fuel’ it and they can’t see a business case for it … yet!

A third and fourth issue with electric trucks, and ones that are perhaps closest to BAE Systems’ area of expertise and experience, are that of reliability and performance. Webb didn’t pull his punches when he said: “With a lot of the implementations that are on the show floors today really look to have a lot of problems!”

They are complex, there are a lot of parts, there are a lot of connections, and there is a lot of wiring, things that we know, first hand, from fielding tens of thousands of electrified buses that operate very severe duty cycles and heavy duty platforms tend to break loose and shake, and cause shorts. Once there are enough of these first generation zero emission trucks on the road, there will be reliability issues. That complexity, of course, also brings a cost with it and an efficiency penalty. And then I think fourthly, ask about performance and whether it can match the diesel internal combustion, the answer is ‘well we can do great performance but not top speed or we can do top speed but not great performance,’ so there's some performance issues.

So Webb suggests right now in the truck market, there's reliability and performance issues, TCO issues, as well as the infrastructure issue!

A case for use of BAE Systems’ product in other market segments

Historically BAE Systems’ main business and experience has been in transit in North America, UK and Europe, but it has also had successful programmes in military ground vehicles (due to the company’s heritage with its core business being a defence aerospace business company) as well as the maritime business during the past decade. BAE Systems has also undertaken installation of hybrid and EV systems in multiple truck programmes over the past two decades, primarily these programmes have hybrid refuse trucks in the USA and UK. It has also conducted many pilot projects with hydrogen fuel cells in transit buses over the past 20 years and more recently in Class 8 EV fuel cell terminal tractor units with a company in the southwest USA.

BAE Systems’ focus today therefore is on the vocational or niche volume market segments of which transit bus is just part but also typically where applications operate in heavy-duty or severe cycles (i.e. run a lot of hours, consume a lot fuel etc) such as refuse vehicles, terminal tractors, airport vehicles, warehouse and campus type vehicles. It is also looking at some off-road applications including mining, where there are a lot of pockets that BAE Systems’ powertrain systems are suitable, again largely because of the duty cycle and where e-drive can bring greater efficiencies. Webb said it is also focussed on these different niche sectors because of politics (policy and funding) as well as the visual image associated with moving to zero emissions to give improved air quality or to reduce noise etc, as well as climate change benefits.

Power electronics expertise at the core of BAE Systems’ drivetrain systems

Why BAE Systems? It is power electronics that is at BAE Systems’ core. It designs and build power electronic systems from scratch, and it has been doing this in aircraft for many decades and in commercial vehicles for over two decades, specifically in transit bus. While it also builds motors and battery packs, with its modular power electronics, it has the flexibility to use outside suppliers of batteries and motors and other components of which there is an increasing number. “There are, however, few other suppliers of power electronics in the heavy-duty mobile marketplace and those that are, often don’t have the same level of experience, as BAE Systems, nor the volume of product in the field!”

The past 25 years of working in the heavy-duty transit bus sector has allowed BAE Systems to gain the right know-how and expertise for designing a serviceable and reliable product in hybrid and electric for this market and other similar application types. With three generations of systems and with the latest Gen3 now being more optimised for electric than for hybrid, although it can do both, … “we think we've learned a lot of lessons and gone through a lot of those steps that the truck market is yet to go through - meaning that our product today is massively consolidated. Our two power electronics boxes or power electronics suite can do what the competition needs say 8 to 10 ‘boxes’ to do!”

Webb pointed out that over the past twenty five years it has brought three generations of power electronics for powertrain and two generations of power accessories to the market. There was very little accessory electrification in its Gen1 powertrain, this was only developed for Gen2, but it has been optimising the drivetrain power electronics and the accessory power electronics since then. This is to take advantage of new chemistries that are out there, said Webb. “So, we're using silicon carbide (SiC) now in its third generation power electronics for drivetrains to make it more efficient. We are using it gallium nitride (GaN) in our accessory power electronics to make them more efficient as well as more compact.” Use of these chemistries in its Gen3* power electronics offers OEMs a system that is more efficient, more compact and easier for the OEM to install.

___________________________________________________________

*Gen3 - A key feature of the latest Gen3 electric drive system is the modularity of the inverter control system - referred to by BAE Systems as its Modular Power Control System (MPCS), the main function of which is to control the primary traction motor - and the ability to add modules for additional battery storage capacity. BAE Systems’ MPCS allows Nova Bus to expand and / or reduce the battery capacity of each bus with relative ease, as its MPCS has additional battery combiners that allow an OEM to add additional battery packs to it.

BAE Systems’ Gen3 comprises four main products:

The MPCS (Modular Power Control System), for controlling the main traction motor and the ability to add modules for additional battery storage capacity.

The MAPS (Modular Accessory Power System), which provides the auxiliary AC and DC (28V) power for vehicle accessories, such as 3-phase AC control of systems like the air conditioning, power steering, air compressors etc,

The GPM-12 permanent magnet electric motor,

The SCU (System Control Unit), which provides an operator interface, system monitoring & control, and ensures optimal power flow to and from system components.

.jpg)

BAE Systems’ GEN 3 components, MPCS (Left), Electric Motor (Middle) & MAPS (Right)

Modular approach – gives flexibility in applications across industry sectors

BAE System has taken a very modular design approach, recognising that there are types of platforms out there that have very different duty cycles as well as very different power considerations. The modular power electronics for the drivetrain and for the accessories from BAE Systems are now highly flexible and highly adaptable and suitable for a wide range of mobile applications in the heavy-duty segment, said Webb. The modular system fits hybrid powertrains including fuel cell hybrids as well as full battery electric configurations. “The system, I would say, is highly flexible, adaptable, modular, very compact, efficient and finally, it simplifies a lot of things. If you look under the hood of most first generation heavy-duty electric vehicles, they're just taking an internal combustion diesel vehicle, which has been designed for that technology for decades and decades and it is not optimised for EV,” Webb stated.

Building accessory electrification systems for more than a decade

Webb said that BAE Systems’ accessory electrification experience is now more than a decade old, first being brought to market in London, UK, in the late noughties and then in North America starting in 2013, once it had achieved application approval from the various government regulatory bodies, not least the engine manufacturer, the EPA and California Air Resource Board.

Accessory electrification has meant OEMs needed to change its mechanical and hydraulic accessories supply chain. This meant those same suppliers had to change and build that up supply chain, which benefited BAE Systems because … “this meant we sold thousands of these systems in hybrid vehicles before the move to full EV.” Today, most OEMs offer EVs based on converted diesel vehicles fitted with off the shelf components. At first this sounds straight forward but often the inexperience leads to excessive use of LRUs (line-replaceable units), interconnects, and excessive use of low and high voltage wiring systems,” said Webb.

25 years of experience

“Electrification is very complex. This drives cost in terms of materials, both installation and bill of materials, as well as cost in terms of reliability and serviceability. Because we have been doing this {power electronics} for decades with our full hybrid solutions, we've learned some things about how to simplify systems resulting in fewer units, more integration, more compactness, fewer interconnects, less wiring and delivering an overall a simpler system that should help to lower TCO. So, we think we bring a very innovative approach to the power electronics. While the power electronics, is not the high value component in EVs, the batteries are, but the vehicle won’t work without reliable power electronics.”

Perhaps the last key BAE skill set is systems integration, said Webb. Working with Specialty builders, and their OEM and Tier 1 suppliers, has made it clear that there is a dearth of systems integration expertise across the heavy duty mobility industry sectors. Specialty vehicles is, by definition, low volume, said Webb, and so there isn't a lot of resource to be applied to systems integration. BAE Systems has probably worked with between 20 to 30 different OEMs over the years, so it knows a lot about systems integration.

Opportunities

BAE Systems’ PPS business is highly adaptable, and so is talking to both the established OEMs and the disruptors in the on-road, off-road and other niche mobile markets. Some are more receptive that others, said Webb, depending on the stage they are at and on their success with their systems and acceptability in the marketplace. Webb sees that the big OEMs will look to vertically integrate electric propulsion, because, firstly this is what they have done in the past and secondly, because they can and it makes economic sense in the long term, but it will take time and investment {Ed. as we are seeing almost daily}. Meanwhile, the (truck) market is moving fast, said Webb. At the same time there are disruptors, whose aim is to get to market faster than the legacy OEMs, to sweep up early orders and benefit from the transition curve – they are also there to supply OEMs with Gen 1 and 2 systems to allow the OEM to meet market demand while creating time for their own in-house electric powertrain development (e.g. Mack Trucks’ decision to go with Sea Electric).

Webb said that with the truck market it was probably late to market to fulfil the wave of first generation vehicles, but now, he said, BAE Systems was gearing up to address the second generation truck platforms in development today. He sees an opportunity to take the systems from transit today and adapt them to truck and other applications. For transit, it offers a large electric motor with a powerful invertor that can manage well the required grade and top speed without a gearbox. At ACT Expo May 2023 it announced a partnership for truck with Eaton Corporation to develop a centre drive with a gearbox combination for heavy-duty truck applications. This would allow, Webb explained, BAE Systems to lower its costs (due to a reduction in use of certain raw materials such as copper in the motors for example) but also to further extend the range of solutions it can offer the marketplace.

BAE Systems is also looking at a whole range of partnerships to offer different combinations in different industry segments. It currently has a fuel cell partner, Plug Power, it has a transmission partner, Eaton Corporation, an electric motor partner, and in the future, it plans to have an axle partner.

Webb remarked that while it is still focussing on the niche severe-duty cycle vehicle segments - where there is a bigger payoff in terms of fuel savings and where BAE Systems has a track record of providing durable, reliable and efficient product - it is not closed to the higher volume opportunities.