2024 ACT Show Report

By Luke Willetts - 9th July 2024

The ACT Hall (2024)

USA – After attending the 2023 Advanced Clean Transportation (ACT) Expo last year we concluded that “people will soon have less and less reason to claim that America is behind Europe” in terms of decarbonising the transportation industry. This year, after attending the 2024 edition of ACT- held at the Las Vegas Convention Center between May 20-23 – we reiterate that sentiment.

The first day of the event took place in the “knowledge zone”, where all the various seminars took place including workshops on Battery Technology, Automation, Hydrogen and Policy & Regulation. Many of the same debates cropped up during these seminars (battery electric vs hydrogen technologies) yet, the robust disagreements were premised on the understanding that the North American transportation industry must decarbonise. There was certainly a sense of optimism in the air, with a feeling that the industry is moving in the right direction. Having said that, many of the bottlenecks that plague Europe, such as the lack of charging/hydrogen refuelling infrastructure, remain an impediment to the widespread adoption of zero-emission commercial vehicles. This is where certain cities (and or States) have taken a proactive approach, especially in the City of Dallas, which announced at the show, a ten-year deal with Ford Pro (Ford Motor Company) to install and manage its Ford Pro EV chargers to power the city’s light-duty municipal fleet.

Seminar room at ACT 2024

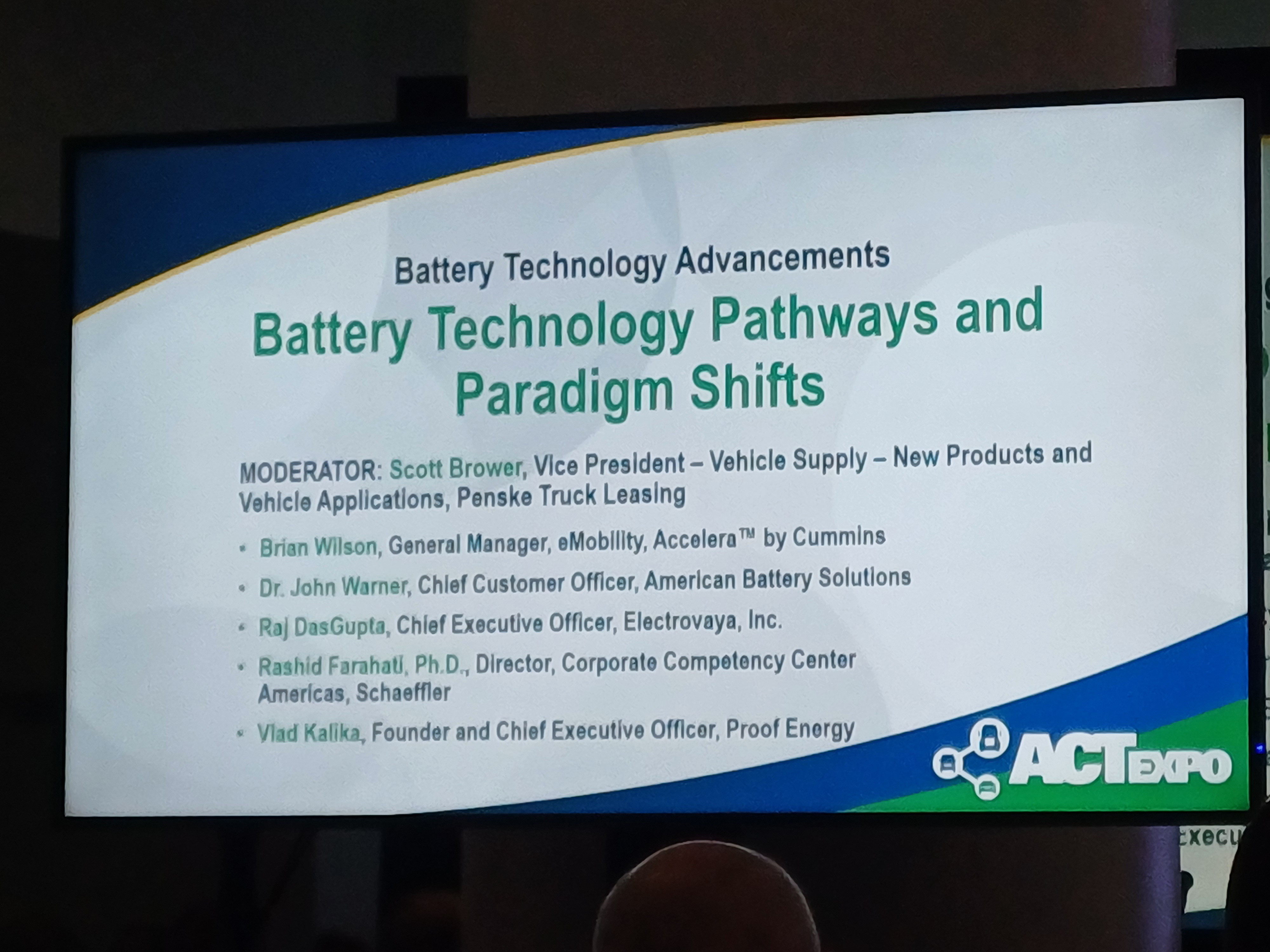

We sat in on the “Battery Technology workshop” where a panel of industry experts discussed the current state of the North American EV HGV industry. Brian Wilson, General Manager of Accelera (the zero-emissions business unit of Cummins) spoke of his concern about the overreliance on the Chinese battery supply chain. Plans are in place to remedy this with billions of dollars being poured into localising battery (and cell) production in the U.S. One of these projects that has grabbed mainstream headlines is the joint venture between Accelera (Cummins), Daimler Truck and Paccar to create and scale cost-effective and differentiated battery cell technology for medium- and heavy-duty electric commercial transportation. Whilst plans for a 21 gigawatt-hour (GWh) manufacturing facility in Mississippi have recently been announced, the facility is only expected to come online in 2027.

Battery Technology Advancements seminar at ACT 2024

Also on the panel, Dr. John Warner, Chief Customer Officer at American Battery Solutions, who said in no uncertain terms that the company is hoping to benefit from localising battery cell production in the U.S. “The chemistry is evolving quickly, and so is battery architecture”, meaning more cells and bigger packs with more efficient performance. Continuing down this trajectory, increasingly ever more power-dense batteries will need to be serviced by megawatt chargers. All of the EV charging manufacturers either demonstrated megawatt charging prototypes or announced megawatt projects. Both ChargePoint and Kempower debuted a 1.2 Megawatt Charging System (MCS) designed to charge electric HGV trucks. Whilst we are told that the megawatt charging technology is proven, issues surrounding power/grid management remain a concern, especially in towns/cities where grid capacity is already stretched like in California. This will also require costly circuit infrastructure to handle drawing large quantities of electricity from the grid. Who will fit the bill?

Brian Wilson, General Manager of Accelera at ACT

Many executives told us that State and Federal funding make a positive contribution in the here and now, but it is the ubiquity of HGV public charging infrastructure that will drive the longevity of the commercial electric vehicle growth in the U.S. This lack of infrastructure is mirrored on the other side of the pond, with ACEA (European Automobile Manufacturers’ Association) at constant loggerheads with the European Commission over Euro VII and lack of public charging infrastructure to service the rollout of electric trucks across Europe. This point was driven home by Raj S. DasGupta, CEO of Canadian battery manufacturer Electrovaya, who told the audience that the development of megawatt charging technology needs to be met with clear guidelines on installation, implementation, federal funding, energy policy and of course battery recycling. Daimler Truck North America LLC (DTNA) took the lead on the latter and spent most of their press conference highlighting its circular economy approach” to battery recycling, remanufacturing and repurposing of its lithium-ion CV battery packs. Ultimately, there was tremendous value in bringing many of the industry leaders under one roof to discuss these concerns, and hopefully plot a way forward.

ACT Main Conference Hall

Once the seminars concluded, we were led onto the showroom floor where many of the OEMs, such as GreenPower, Lion Electric, Mack Trucks, Oshkosh, McNeilus, Navistar and Blue Bird, displayed new electric vans, trucks and school buses. With the billions of dollars of federal funding being poured into the development and procurement of zero-emission transportation technology through the Bipartisan Infrastructure Law, it was no surprise that a sticker with the slogan “this vehicle qualifies for federal grants through the Low or No Emission Program” was slapped on almost every vehicle.

Another tactic to mitigate this high upfront cost of procuring these electric vehicles is the “truck as a service” business model, punted by the likes of Navistar and Volvo Group North America who offer a full package (“turnkey solution”) from consultation, route planning, vehicle financing/leasing, charging infrastructure (installation, management and maintenance), driver training, servicing & maintenance and insurance, providing customers with everything they need to operate an electric vehicle.

Another caveat is the promise of “fleet telematics & digital solutions” driving fleet efficiency and lowering Total Cost of Ownership (TCO). Companies like Geotab, design specialised software (Geotab ACE) which collects, analyses and leverages data that drive analytical insights that contribute toward fleet efficiency for the operators. At ACT the company announced that it will integrate Rivian’s data into its platform, enabling fleet managers to optimise fleet performance and plan routes more accurately. Fleets will further benefit in terms of compliance, safety and ultimately productivity, helping owners reduce costs by maximising vehicle uptime.

Finally, the holy grail that is autonomous vehicles made a splash, with the likes of Hyundai Motor Company and Plus launching the first fuel-cell electric truck with autonomous driving capabilities (The Class 8 ‘Xcient’ model). Volvo Group North America followed suit with its autonomous VNL truck, a project which it has worked on with Aurora over the past three years. At the launch, we bumped into the President of autonomous vehicle software company, Aurora Innovations Inc, Ossa Fisher, who reiterated that point, “the technology is there, it’s the regulation that has to catch up” she said. We have been promised for years that fully autonomous vehicles are “just around the corner” but evidently, we will need the legislation and more importantly, the insurance companies all singing from the same hymn book before this is a possibility, at least commercially. Fisher told us that autonomous vehicles are the next great leap forward, complimenting electrification. Many fully autonomous vehicles are currently operating in logistics centres, warehouses, cargo ports and airports. We have seen in Europe, electric bus builder Karsan roll out its fully autonomous buses on public roads in the likes of Finland and Norway. We have moved out of the realm of science fiction and into the practicalities of implementing these vehicles, according to Fisher. Fully connected fleets have the power to optimise challenges around the range, TCO, driver shortages and vehicle payload, four issues that have long been holding the industry back on its decarbonisation journey.

Fighting the urge to hit the strip and eventually end up at the Craps table in the infamous Caesars Palace casino, the T&BB team spent four days meeting with various industry leaders from startups, think tanks, logistics companies, components suppliers and legacy OEMs, compiling an extensive report of the new products, projects and technologies proliferating the North American zero-emission transportation industry.

Trucks

There were undoubtedly more battery-electric vehicles on display than fuel-cell electric or hydrogen-powered. Whilst North American OEMs have traditionally had a greater emphasis on the medium-duty truck segment of the BEV market with brands such as Rizon, there was a dearth of new electric HGVs on show.

Marc Bedard, CEO and founder of Canadian electric vehicle manufacturer, The Lion Electric Co, based in Saint-Jérôme, Quebec, unveiled its new Class 8 battery-electric truck (Lion8 Tractor). Currently in series production in Joliet, Illinois, the 127,000 pound (57.6 tonnes) GVW truck is powered by a TM4 Sumo electric powertrain from Dana and is fitted with a 630 kWh battery pack which provides a range of 275 miles (440kms) on a single charge. Fast charging capabilities allow the vehicle to charge up to 80% in 1.5 hours. The 6X4 axle configuration has two integrated two-speed eAxles ensuring optimal power distribution. Additional features include an ADAS system, fleet telematics software (LionBeat) and an onboard weighing system further optimising vehicle safety and operational efficiency.

Marc Bedard, CEO and founder of Lion Electric unveiling the Lion8 Tractor at ACT 2024

GreenPower Motor Company displayed its new refrigerated Medium-Duty Truck, the EV Star REEFERX. Designed for the mid to last-mile fresh and frozen foods delivery market, the vehicle is built on its own (GreenPower’s) EV Star Cab chassis and has a payload capacity of up to 5,500 lbs (2.45 tonnes). Brendan Riley, President of GreenPower told T&BB that orders are now open with series production set for Q4 2024. Manufacturing will take place at its new facility in Charleston, West Virginia, USA.

The truck is a one-piece box design, offering multi-temperature zones to accommodate a variety of items. Powered by a TM4 electric powertrain from Dana, the truck is fitted with a 118 kWh battery pack which provides a range of 150 miles (241 kms) on a single charge. Additional features include an ADAS system and fleet telematics software (optional) further optimising vehicle safety and operational efficiency.

Staying with battery-electric, Hino Motors Ltd and Hexagon Purus ASA of Ålesund, Norway, announced the launch of its EV truck brand, Tern, which debuted its first model, the class 8 battery-electric RC8 truck. The vehicle is set to go into series production in Q4 2024, at Hexagon’s new 200,000-square-foot vehicle integration facility in Dallas, Texas. Initially set to be released in the U.S. market, the 68,000 lbs (30 tonnes) GVW truck is built on the Hino XL Series 4X2 chassis and is powered by a 680-peak horsepower electric motor (494 continuous). The truck is fitted with a 538 kWh battery pack (lithium-ion) from Panasonic Energy, which provides a range of 200 miles (321 kms) on a single charge. Fast charging capabilities allow the vehicle to charge up to 80% in two hours. The Tern RC8 also features an e-Axle from Dana ensuring optimal power distribution. Tern trucks will be available through the Hino dealer network across the U.S.

Tern RC8 Truck

There were plenty of “special trucks” on show, especially from Mack Trucks Inc who presented three electric trucks, including one fully-electric waste collection vehicle with a side-loading body. Executives told us that they had recently delivered the first ‘LR Electric’ waste truck to the city of Portland, Maine. The ‘LR Electric’ truck on display had a ‘RevAMP Automated Side Loader’ body fitted by Heil Environmental Industries of Chattanooga, Tennessee. The lift arm, compactor, and auger are fully electric and run on an independent battery pack, with a capacity of 46kWh – enough, Mack claims, to pick up more than 1,200 bins on a single charge. To accommodate the electric refuse body, Mack removed the electric power take-off unit and alter the LR Electric’s centre of gravity “due to the dense packing capabilities of the auger system”.

Alongside the LR Electric, Mack presented two examples of the ‘MD Electric’ series. The first was a 150-kWh model fitted with a 15-foot aluminium dump body by R/S Godwin Truck Body Co LLC (of Ivel, Kentucky). The second was a 240-kWh model with a 120-kW off-grid charger powered by propane – a mobile range extender.

Mack LR Electric with Heil side loader

Speciality truck manufacturer Oshkosh Corporation displayed two electric vehicles and a prototype power distribution unit for high voltage electrical systems. The first of two vehicles Oshkosh displayed was the ‘Next Generation Delivery Vehicle’, custom built by Oshkosh Defense for the United States Postal Service. Oshkosh is contracted to deliver between 50,000 and 165,000 units over a 10-year period. Although this includes a mixture of combustion and battery-powered vehicles, the van on display at ACT was an electric model.

The other vehicle was the ‘Volterra ZSL’, built by subsidiary McNeilus. It is a battery electric refuse truck with integrated chassis and body, designed from the ground up by McNeilus. Oshkosh said that, with its ‘glasshouse’ cab offering wide visibility, the vehicle puts the driver first, making it easy and safe to operate.

Finally, Oshkosh presented a prototype from another subsidiary, electrification specialist Pratt Miller of New Hudson, Michigan. The power distribution unit is designed to deliver power to all critical loads within an electric vehicle, including traction and auxiliary loads, while protecting electrical and electronic components as well as the vehicle occupants from high voltages. Pratt Miller’s electrification expertise supports not only its sister companies within the Oshkosh group, but also third parties looking to develop a new electric powertrain.

Volterra ZSL at Oshkosh stand at ACT

Moving onto fuel-cell electric trucks, Symbio, the Michelin-Forvia-Stellantis fuel-cell joint venture based in Fontaine (Isère) presented its fuel-cell electric truck – the result of a California state-funded truck project which began two years ago. The truck displayed was a ‘Freightliner Cascadia’ 6x2 tractor unit powered by Symbio’s 400-kW ‘StackPack’ fuel cell system. Developed for the “H2 Central Valley Express” project, the prototype fuel cell truck is intended to match the performance of a 15-litre diesel truck in regional haulage. At the end of this year, the truck will be taken on the road by Total Transportation Services Inc in a 12-month trial. Michelin, one of the primary shareholders of Symbio, supplied low-rolling resistance tyres for the project, designed to reduce the truck’s energy consumption.

Symbio prototype fuel cell truck

The once embattled American truck manufacturer, the Nikola Corporation of Phoenix, Arizona displayed its fuel cell and battery electric truck models alongside a ‘Hyla’-branded hydrogen fuel dispenser and a Chargepoint charging unit. The company also displayed the ‘eAX 840-R’ electric axle, the Nikola Tre’s drive unit which is produced by FPT. Representatives announced a 100-unit order for its fuel cell electric trucks from AiLO Logistics of Compton, California. The Nikola ‘Tre FCEV’ trucks will serve AiLO in drayage operations in the Ports of Los Angeles and Long Beach. Ordered through Tom’s Truck Centers, the 100 vehicles will be delivered next year. This latest order from AiLO follows a 50-unit order which it made under its old name of ‘AJR Trucking’. Nikola reports that it has commenced deliveries of trucks from the first order.

Nikola Tre FCEV in AiLO livery parked outside the Las Vegas Convention Center

A few new company logos popped up, including that of Japanese truck manufacturer, ZM Trucks who made its North American debut. Based in Tokyo and owned by Zo Motors Co Ltd, the company displayed four electric vehicles and announced its plans for entry into the North American market in 2025. The company displayed a combination of battery and fuel cell electric trucks, including two Class 6 models (battery & fuel cell) called ‘ZM8’, and a Class 8 model (battery) called ‘ZM22’. (A fuel cell version is also available). Also on display was a battery electric van called ‘ZM4’. ZM Trucks stressed that the models on display were built for the Asian market and were not entirely representative of what the company planned to bring to market in North America starting next year. ZM Trucks aims to establish local production of the vehicles for the North American market in Torrance, California by November 2024 and Toronto, Canada early next year.

ZM 22

Vans, Buses and School Buses

There were certainly fewer buses, vans and school buses on the show floor than we had initially anticipated. However, once you left the cool airconditioned expo centre and ventured out into the blistering heat, you entered the “Ride & Drive” track. This is where many of the school buses and vans could be located.

We know that the electric school bus market in NA has been given a shot of life with the USD 5 billion / 5-year U.S. Environmental Protection Agency’s (EPA) Clean School Bus Grant Programme which aims to replace 500,000 internal combustion school buses with zero-emission school buses to qualified school districts intent on offering cleaner transportation alternatives. Last year saw a USD 400 million funding round, with the likes of Greenpower, Gillig, BYD, Navistar, Blue Bird and Phoenix Motor –to name a few – all vying for a piece of the proverbial pie (tenders).

Ride & Drive Area at ACT

School bus manufacturer, Navistar Inc of Lisle, Illinois displayed its latest IC Bus ‘CE Series’ school bus. What stood out in the van segment, was the debut of a battery-electric step van from Blue Bird. Commercially available later this year, the vehicle on display had powertrain components supplied by Xos Inc and a body from Morgan Olson alongside a stripped chassis to show off the powertrain. This is the first vehicle of its kind to be built by the school bus manufacturer. Based on a 178” wheelbase, the van boasts a gross vehicle weight of up to 23,000 lbs. For the electric powertrain, Blue Bird partnered with Xos, which for several years has produced step vans with Dana motors and a battery pack designed in-house with lithium-iron-phosphate (LFP) chemistry. The 140-kWh battery provides up to 130 miles of range.

Blue Bird step van and stripped chassis

Charging Infrastructure & Refuelling

The floor was awash with new electric charging companies aiming to capitalise on the EV revolution. As previously aforementioned, the lack of CV charging infrastructure in the U.S. is a major concern for fleet operators, especially those in the interstate logistics business.

Representatives from Californian-based electric solutions provider, ChargePoint Holdings Inc told us that its Megawatt Charging System (DC) will be available on ChargePoint’s Power Link 2000 stations. The system is capable of dispensing 1.2 megawatts (MW), enough electricity to power 1,000 homes. Furthermore, the system supports bidirectional charging capabilities, allowing customers increased flexibility.

ChargePoint Megawatt Charging System

Tomi Ristimäki, CEO of Finnish electric charging provider Kempower, confirmed that its MW chargers are expected to go into series production later this year and initially, will be rolled out in Finland and then later to other parts of Continental Europe and North America. This new charging solution has been built using Kempower’s proprietary technology, including its liquid-cooled charging plug and two 600 kW Kempower power units, all developed in-house. Unused power can be distributed among several high-power CCS2 outputs within the same system which facilitates the transition toward widespread MCS adaptation.

Ristimäki told us that its new production facility in Durham, North Carolina is now operational. This is Kempower’s second factory but the first in North America with the primary facility in Lahti, Finland. This expansion will further help Kempower to service the North American market with its Kempower C- and S-Series range of electric chargers.

The ribbon cutting ceremony held on June 4, 2024. In the middle, Kempower CEO Tomi Ristimaki with North Carolina Governor, Roy Cooper

We had a fruitful meeting with the recently appointed Vice President of Operations of ChargeTronix Inc, Stephen Israel. Founded in 2022, the proverbial new kid on the block debuted its 480 kW Nexus Distributed Charging System, capable of charging up to six class 6 vehicles (medium duty) simultaneously. Israel told us that the company offers maintenance and installation services to its North American customers. Israel went on to tell us that the company is in the process of scaling production.

Several other products were on the stand, including the 180 kW Apex DC Fast Charger, the Flux AC Chargers (48 Amp and 80 Amp Flux AC single and double chargers) and the Phoenix Bidirectional Charger (V2G), which enables two-way electricity flow between electric vehicles and the power grid.

Stephen Israel, ChargeTronix, Vice President of Operations

On the hydrogen infrastructure side of things, we spoke to representatives of Robert Bosch GmbH about its comprehensive multifaceted hydrogen strategy in the transport industry. Having invested USD 530 million in the development of hydrogen technologies just last year, the aim is to create a complete hydrogen value chain from the production, distribution (storage tanks), consumption (hydrogen engines) and management (telematics) of green hydrogen at scale. Currently, the company is engaged in multiple projects throughout this value chain.

Representatives told us that the company is developing “cryopump” technology to support faster re-fuelling times, utilising existing powertrain technology where necessary. Bosch claims that “90 percent of existing development and manufacturing technologies can be re-utilised, as the basic structure of the fuel, air and exhaust system can be adopted from existing powertrain solutions.” The aim is to refuel HGVs with 100kgs of hydrogen in 10 minutes or less.

Bosch has been collaborating with the Southwest Research Institute (SwRI) that retrofitted a Class 8 heavy-duty vehicle with a hydrogen fuel cell engine. Bosch developed the fuel cell stack, the electric air compressor, the anode recirculation blower, the anode module, the hydrogen injector, the fuel cell power transfer unit and the fuel cell control unit. The first Bosch hydrogen fuel cell engine is scheduled to debut in Q4 2024.

Finally, in terms of hydrogen production, the company is developing electrolyser technology, involving the electrolysis stack responsible for using electricity to split water into oxygen and hydrogen.

Autonomous Vehicles and Fleet Telematics

We have mentioned both the Volvo autonomous VNL truck and the Hyundai Class 8 ‘Xcient’ model, installed with Plus ‘SuperDrive’, a hardware and software package (including lidar, radar, and cameras) which allows for vehicle autonomy up to Level 4. Representatives from both Volvo and Hyundai provided no concrete plans for commercialisation.

Representatives from Swedish freight mobility company, Einride AB told us that the company has partnered with multinational logistics firm DP World, to provide the largest electric autonomous freight fleet in the Middle East. At the end of 2025, a pilot programme will see Einride supply a fleet of 100 digitally optimised (by the Einride Saga digital freight operating system) electric heavy-duty trucks at the Jebel Ali Port, Dubai, supporting 1600 container movements a day, which aims to save up to 14,600 tonnes of carbon dioxide equivalent (CO2e) and 158 tonnes of nitrogen oxides (NOx) annually. All the vehicles will have customised Einride solutions to ensure optimal suitability for freight transport.

Einride and DP World partnership

Components, Supply Agreements and Joint Ventures

As the premium show in NA, this was a great platform to announce new projects and joint ventures, non-bigger than the supply agreement between Hexagon Purus ASA set to supply hydrogen storage and battery packs to Toyota Motor North America Inc for the series production of its heavy-duty fuel cell powertrains. These HFC powertrains will be manufactured at the Toyota facility in Georgetown, Kentucky, a facility dedicated to the production of dual fuel cell modules for use in class 8 heavy-duty trucks. The high-voltage battery packs that are set to be supplied have a 693V max system voltage with a maximum installed capacity of 247 kWh and a typical usable capacity of 218 kWh. The two companies have worked together on Class 8 fuel cell electric powertrains since 2017, where they initially developed the proof of concept Alpha truck for use in Californian ports.

Hexagon Purus stand at ACT 2024

BAE Systems Inc and Eaton Corporation announced they had successfully tested their integrated electric drive system on a Class 7 demonstration vehicle at Eaton’s proving grounds in Marshall, Michigan. The vehicle was on display at the show. The collaboration was first announced the year prior, at ACT 2023, where the companies announced the plan to offer a solution for the medium- and heavy-duty commercial truck market. The vehicle system combined BAE Systems’ power-dense electric motor and advanced silicon carbide/gallium nitride power electronics suite with Eaton’s medium-duty four-speed (4-speed) EV transmission. This system can also be fitted with Eaton’s HD-4 EV transmission, offering electric drive systems for commercial trucks (19 tonnes and over). The benefits of the system, according to BAE Systems, is the reduced number of components, cables and connections which save space and weight. This also simplifies the integration process whilst lowering overall cost.

BAE and Eaton Demo Truck

Hexagon Agility LLC held a press conference to announce an agreement with Norwegian electric transmission company, Brudeli Green Mobility to collaborate on “Near Zero Emission Vehicles” (NZEVs) for the North American class 7 and 8 truck market. The companies are set to integrate Hexagon’s NG/RNG systems with Brudeli’s plug-in PowerHybrid technology to allow fleet operators the ability to maintain diesel ICE duty cycles while providing fuel cost savings. The companies plan to introduce the first pilot trucks with this technology in 2026, with serial production slated for 2028.

Brad Garner, SVP of Customer Care at Hexagon Agility

Finally, in the components segment, Eaton Corporation unveiled new high-powered fuses (Eaton Bussmann series) for electric CVs. Capable of handling up to 1400 amps and 900 volts, these fuses are customisable, meaning they can be tailored to the customer's particular specifications. Paralleling multiple fuses can increase current capability. According to the company, various stages of testing in multiple environments mean the product is safe to operate in all weather conditions and is resistant to thermal shock.

Eaton engineer performs tests on a fuse for electrified commercial vehicles

Furthermore, Eaton announced it opened its newly revamped 65,000-square-foot assembly plant in Santiago de los Caballeros, in the Dominican Republic. The facility is set to increase the supply of its high-powered fuses for EVs and other applications. The 10 million USD investment in this facility is part of a 750 million USD investment strategy into the company’s North American manufacturing base.

Miscellaneous

Very little was said about battery recycling, apart from Daimler Truck North America LLC (DTNA). As part of its carbon reduction goals, the approach aims to extend the usability of its batteries and reuse rare-earth materials in the production of new products. DTNA plans to not only maximise the life span of a battery but also reduce waste.

The initial repurposing process involves partner, Nuvation Energy, who is currently piloting a battery energy storage system (BESS) designed to assist in charging, peak shaving, backup storage and microgrid scenarios. DTNA can therefore repurpose batteries that are unable to be reused in a commercial vehicle. The first of these repurposed batteries will be placed at DTNA’s heavy-duty electric truck charging site (“Electric Island”) in Portland later this year.

Daimler Truck NA stand at ACT

The remanufacturing process is currently taking place at the Detroit Diesel Remanufacturing locations across the U.S. and involves the partial disassembly and module replacement of the battery. Then the battery is tested under quality and safety protocols. These products are then offered back into the market as a cost-effective and environmentally friendly alternative to a new battery pack.

Finally, alongside recycling partner Li-Cycle, critical materials within the battery can be extracted and what is left is recycled. DTNA claims that Li-Cyle recycles these materials in a liquid solution that achieves “up to a 95% recovery rate for returning critical materials back to the battery supply chain.”

Just a gentle reminder that the 2025 edition of the Advanced Clean Transportation Expo returns to California, at the Anaheim Convention Center from April 28 – May 1 (2025).